Table of Contents

How Do I Set Up My Personal Tax Account

- What Can I Do with My Personal Tax Account?

- What are the Benefits of setting up a Personal Tax Account?

- Is it easy to Set up My Personal Tax Account in the UK?

- How can I create my personal tax account?

- Can mPersonal Tax Account Help Review my National Insurance Record?

- Can my Personal Tax Account Help Review my Employment Records?

- Can Personal Tax Accounts Provide Information on PAYE codes?

- Is your Personal Information Secure?

- How Can I Ensure Nobody Accessed My Account?

- Does HMRC Ask for Personal and Financial Detail?

- Conclusion

- Recent Posts

A personal tax account is an HMRC-initiated system to make the tax system in the UK more efficient and transparent. This system facilitates you to access all your tax-related personal information in one place. Through your tax account, you can solve your tax issues on time by yourself without writing or calling the HMRC. You are probably wondering, how do I set up my personal tax account?

If you have access to your personal tax account, it means you can save a great deal of your time and energy. You can manage and handle your tax matters in a much better way. The personal tax account system was started in 2015 and it has been a splendid success since then as it saves countless hours by dealing with everything online. Surely, it is for the best that you set up your personal tax account.

What Can I Do with My Personal Tax Account?

The list of services for the personal tax account is constantly expanding and growing. Therefore, you can avail of many useful financial services from your personal tax account that include:

- Checking income tax code.

- Finding the national insurance number.

- Organising tax credits.

- Claiming a tax refund.

- Checking your income tax estimates.

- Paying overdue taxes.

- Updating or checking your marriage allowance.

- Checking the latest updates on the value of the state pension.

- Adding a family member or other trustworthy person to manage your account on your behalf.

- Viewing your self-assessment tax calculation, which might be helpful in applying for credit.

If there is any error or miscalculation in anything like details or anything else, you can change it by yourself. This guide will help you comprehend how do I set up my personal tax account.

What are the Benefits of setting up a Personal Tax Account?

The personal tax account system is an attempt by the HMRC to make the taxation system more transparent and efficient. With the use of this taxation system, it becomes easier for you to update the HMRC about the changes to your circumstances, like getting married, having a baby, and changing your address. It enables you to change your child’s benefits circumstances, such as if the child joins or leaves education or training. If you are a parent, then you can keep track of child track credits. you can check or update the benefits you get from your work such as car insurance, or company car details.

The major benefit of the personal tax account is that everything relating to your tax affairs will be online in one place. Hence, you will not have to spend time finding out different papers to get the details of your taxes.

Also, creating your personal tax account enables you to monitor your tax-related affairs to make sure that your records are accurate and up to date.

It is less time-consuming, more transparent, less difficult, more immediate, and entirely paperless. This process does not require lengthy letters but easy texting messages or emails- so you will be doing good for the environment too. Thus, it is an ideal situation.

Is it easy to Set up My Personal Tax Account in the UK?

Certainly, it is human nature to envisage every new thing as difficult until becoming familiar with it. But setting up your personal tax account with HMRC is like something easier done than said.

Setting up a personal tax account is not time-taking or technicalities involving the job at all. According to HMRC, it should only take 5-10 minutes.

To start with, you must log in to your government gateway account.

The form online available is itself much easier to follow as it simply involves inputting your information and setting up security protocol. At this stage, the time factor entirely depends on the organization of the paperwork you start with. The more your paperwork is organized, the less time will it takes. Let’s discuss the paperwork you require to understand how I set up my personal tax account.

What do you need to Apply for the Paperwork?

- National insurance number.

- Recent pay slip.

- UK passport (must be on date) or most recent P60.

- Landline number or your mobile number, as part of the two-step security.

- Choose the email address you want to attach to the account.

Now, you have acquired all the needed information to set up your personal account. Just go to the government gateway, and select either individual, (if you represent your own business) or agent (if you represent other people in financial matters to the government) to start the registration process.

How can I create my personal tax account?

There are a few steps to set up your personal tax account. We share those steps one by one in a largely simplified way.

1. Registration

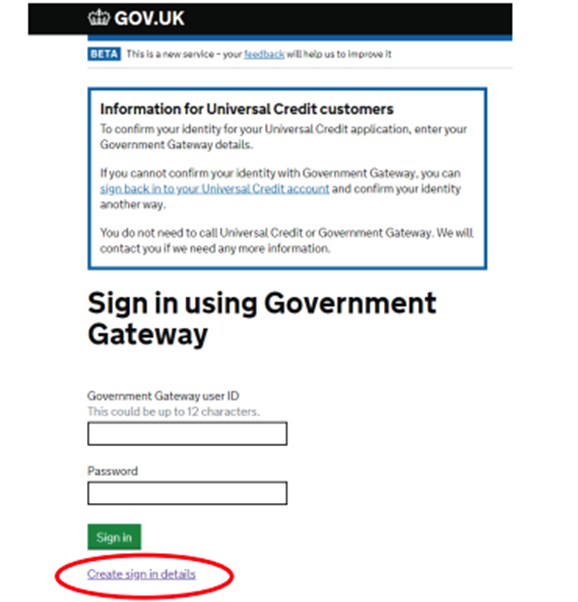

You will need to register online by using this link on the official website of the HMRC to access the personal tax account.

Click the ‘create sign-in details’ link given below the sign-in button to begin the registration process.

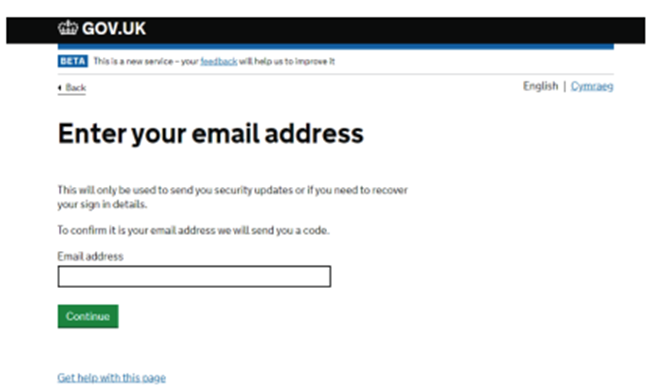

Then you will have to enter your email address. After doing so, select Continue.

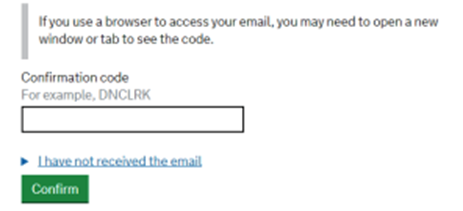

You will receive a code of 6 characters from HMRC at this email address.

Once you have entered the details in the given box, HMRC will prompt you to enter your full name and create a password. Then you will see your Government Gateway ID number.

2. Setting up your account

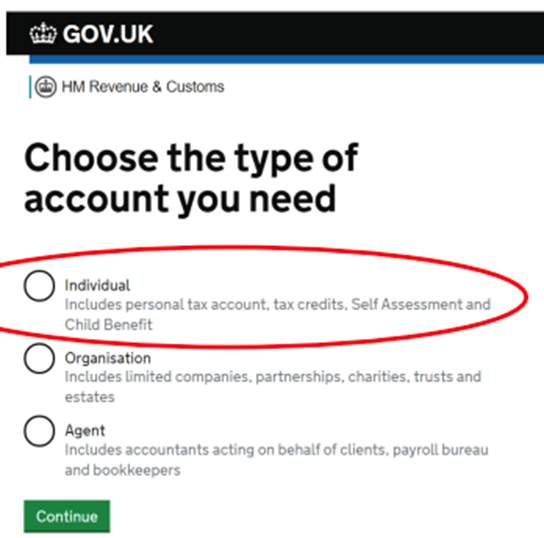

Here the HMRC will ask you to select the type of account you need. Please select “individual” and then click the green button of “continue”.

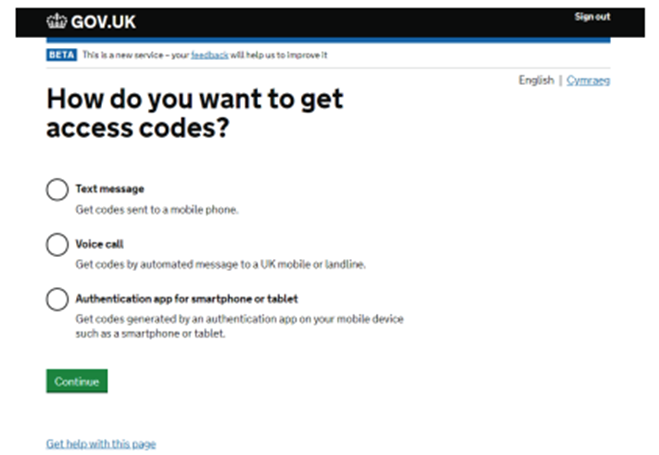

Now the HMRC will ask you to set up a method to receive an access code. It is important to know that select a method you are quite comfortable with because HMRC will use this method to send you an access code, every time you sign by using your Government Gateway user ID.

After selecting the method, you are most convenient with, click on the green button of “continue”.

Then HMRC will ask you to enter the 6 digits access code it has provided you with.

Kindly, enter the code and then click the green button “continue”.

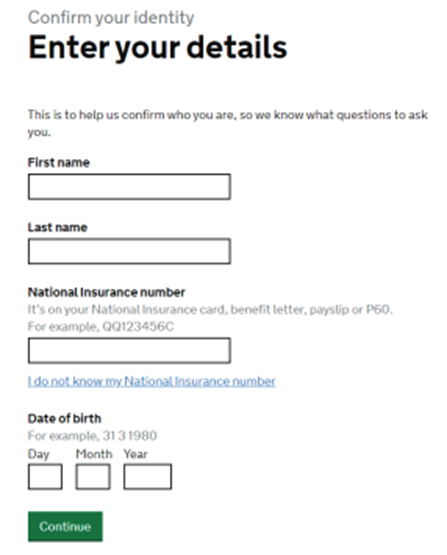

Now HMRC will ask you to confirm your identity, please provide the details where asked and then click the green button of “continue”.

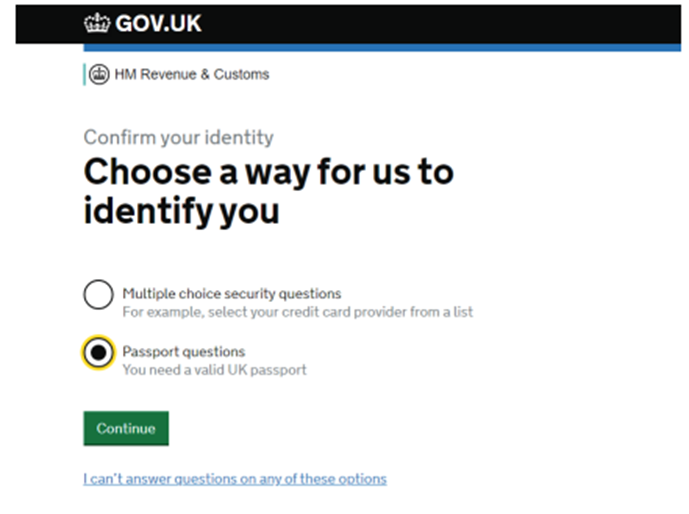

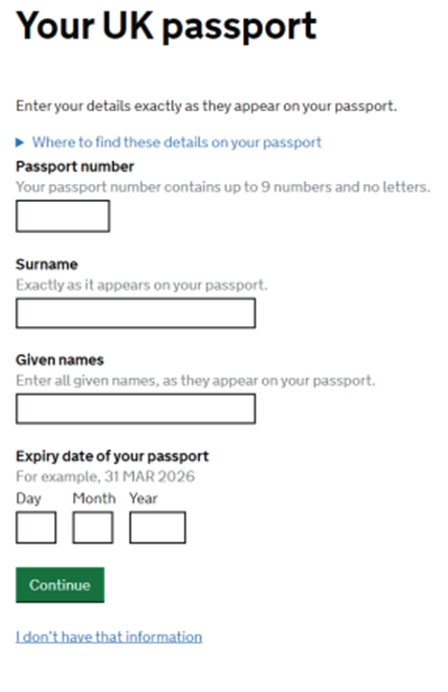

Now HMRC will ask you the way you want your identity o be confirmed by the HMRC. If you are a UK passport holder, you are recommended to use this option.

HMRC will ask you to share the same detail you have on your passport. Please enter the required details and then click the green button of “continue”.

Now HMRC will confirm whether the details you entered are correct and whether the personal tax account has been successfully set up. After its confirmation, you will be asked whether you would like to receive your correspondence regarding your tax affairs electronically or post via your Personal Tax Account. please select the option which is most suitable to you and select the green “continue” button. Now you will be taken to the Personal Tax Account home page.

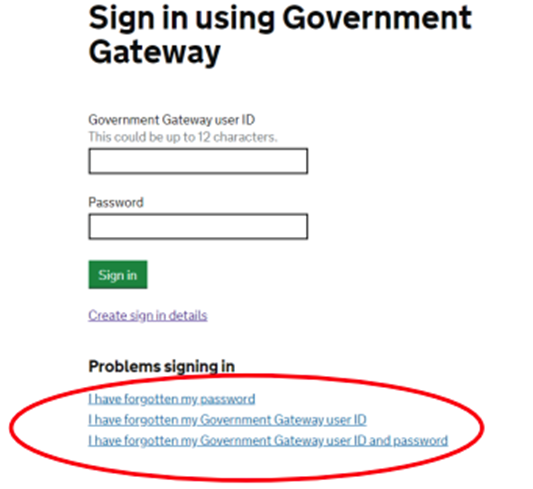

3. Recovering Login Details

If you have previously used the online services of the government Gateway or HMRC to submit your tax returns electronically via the website of HMRC. You must log in by using those account details. But if you have forgotten the details of those accounts then please select one of the links given at the bottom of the sign-in page depending on the details you need to recover.

Now HMRC will take you, according to its process to recover your Government Gateway user ID or password.

If you face any difficulty with the process, you can easily contact HMRC for help.

Safety and security with your Personal Tax Account

After completing the registration procedure, you are the only person to have access to your personal tax account with your user ID and password.

Therefore, that answers your question, how do I set up my personal tax account?

Can my Personal Tax Account Help Review my National Insurance Record?

When it comes to reviewing your National Insurance record, your personal tax account can be particularly helpful. You can easily review your national insurance record that covers your entire working history by accessing your personal tax account. Reviewing your National Insurance record helps you ensure that your entire record is accurate and up to date. It also identifies any gaps in your contributions that might need to be addressed.

After that, when you reach the pension age, you can ensure that you have the correct credits to receive a full pension. If you find any discrepancies and gaps, the best option is to contact HMRC for investigation.

Can my Personal Tax Account Help Review my Employment Records?

Yes, your personal tax account gives you the additional benefit of reviewing your employment records.

It’s another benefit is that if you cannot obtain a copy of your P60 from your employer, you get it from your personal tax account. Once you understand how I set up my personal tax account, you can move forward with these steps.

Can Personal Tax Accounts Provide Information on PAYE codes?

Another useful feature of a personal tax account is that it enables you to view the PAYE codes use applied to your employment.

Moreover, you also have the option to modify your PAYE code directly from your personal tax account.

Is your Personal Information Secure?

When it comes to security, HMRC takes it seriously and uses firewall protection for all its systems. This is like a bulwark to provide maximum protection for your information because its detective capacity is strong enough to detect any unauthorized entry. All the data that you share with HMRC is encrypted and nobody can see your data except yourself.

Furthermore, you also must be conscious and vigilant of your online safety. Avoid sharing your user ID or password with anybody. If you cannot remember it and want to note it down, then ensure to keep it in a discrete place. Surely, you now have a clear idea of how I set up my personal tax account.

How Can I Ensure Nobody Accessed My Account?

One of the easiest ways, you must know whether someone accessed your account or not is the security measure of the system that shows you the time and date you logged into your personal tax account. Check this list frequently, if see any such thing that does not look right, immediately contact HMRC through their website.

Another safety measure built into the system is automatic logging out of your account if it is not active after 15 minutes. If you are forgetful, don’t worry, the system will secure your account.

Does HMRC Ask for Personal and Financial Detail?

It is important to know, and HMRC often emphasizes to be mindful of the procedure of HMRC that it does not ask for any personal or financial details by email, phone, or text. Always be on watch to protect yourself from the scammer, if notice any such thing as suspicious, report it to the HMRC, even if you have not lost anything. Undoubtedly, it is in your best interest to do so.

Shortly speaking, setting up a personal tax account offers a wide range of benefits by saving you a great deal of energy and time that you can utilize in something more productive and creative. You can easily check state pensions, national insurance contributions, and many other tax affairs online without standing in long queues on helplines or doing related paperwork. It keeps you updated and informed about your tax status. And through it, you can also keep HMRC timely updated and informed about your circumstances. Most importantly, your financial information is safe and secure.

FAQs

How do I activate my UTR number?

If your UTR (Unique Taxpayer Reference) is inactive, you can reactivate it by:

- Contacting HMRC – Call the Self Assessment helpline and request reactivation.

- Providing Personal Details – You may need to confirm your full name, address, National Insurance number, and date of birth.

- Waiting for Confirmation – HMRC will confirm reactivation, usually via letter or phone.

How to check income tax?

You can check your income tax by:

- Logging into your HMRC Personal Tax Account – View your tax payments, liabilities, and tax code.

- Using the HMRC App – Check your tax status on the go.

- Contacting HMRC – If you have queries about your tax records, call them for assistance.

How to file income tax?

To file your income tax return:

- Register for Self Assessment if you haven’t already.

- Gather Necessary Documents – Income records, expenses, and other tax-related details.

- Complete Your Tax Return – Log in to your HMRC account and fill out the SA100 form.

- Submit Before the Deadline – The deadline for online submissions is usually 31 January.

How do I create a UTR account?

To get a UTR number:

- Register for Self Assessment with HMRC.

- Provide Personal Information – Full name, address, date of birth, and National Insurance number.

- Wait for UTR to Arrive – It is usually sent by post within 10 working days in the UK.

How do I check if my UTR is active?

You can check if your UTR is active by:

- Logging into your HMRC account to view your Self Assessment status.

- Calling HMRC – Provide your UTR and ask if it is active.

How to set up self-employed?

- Register with HMRC for Self Assessment.

- Keep Records of your income and business expenses.

- Submit Your Tax Returns Annually to pay the correct amount of tax and National Insurance.

How do I check my UTR online?

You can find your UTR number by:

- Logging into your HMRC account – Your UTR is listed in your tax documents.

- Checking Previous HMRC Letters – It appears on tax returns and payment reminders.

How do I check my active tax status?

- Use Your HMRC Personal Tax Account – Check your tax payments and liabilities.

- Contact HMRC – If you’re unsure about your status, they can confirm it.

How long does it take to get a UTR?

HMRC usually issues a UTR within 10 working days if you’re in the UK or 21 days if you’re abroad.

How much money do you have to make as a self-employed person?

If you earn over £1,000 per tax year from self-employment, you must register with HMRC and file a tax return.

How do self-employed get money?

Self-employed individuals earn money by:

- Charging clients/customers directly for services.

- Selling products online or in-store.

- Receiving payments through invoices, bank transfers, or platforms like PayPal.

How can I make money from home self-employed?

Options for making money from home include:

- Freelancing – Writing, graphic design, programming, etc.

- E-commerce – Selling on platforms like eBay, Etsy, or Amazon.

- Affiliate Marketing – Promoting products for commissions.

- Online Courses – Teaching skills through platforms like Udemy or Teachable.

How to earn $1,000 per day from home?

Earning $1,000 per day requires high-income skills or scalable businesses:

- Dropshipping or E-commerce – Selling trending products online.

- Stock Trading or Cryptocurrency – Requires experience and risk management.

- Freelance Consulting – High-ticket services like business coaching.

- Online Courses & Digital Products – Selling valuable knowledge at scale.

What is the fastest way to become self-employed?

- Identify a skill or service you can offer immediately.

- Register as self-employed with HMRC.

- Find clients through online platforms like Fiverr, Upwork, or LinkedIn.

- Start small and reinvest earnings to grow your business.

How to earn money from Google at home?

Google offers multiple ways to make money:

- Google AdSense – Earn from ads on a blog or YouTube channel.

- Google Play Store – Develop and sell apps.

- Google Opinion Rewards – Get paid for surveys.

- YouTube Partner Program – Monetize videos through ads and memberships.

click here for more